Josef Stalin Would Have Approved of Bitcoin

“Quantity has a quality of its own.”

Josef Stalin, spoke about how the overwhelming tank production of WWII allowed the USSR to defeat Germany, even though German tanks were vastly superior.

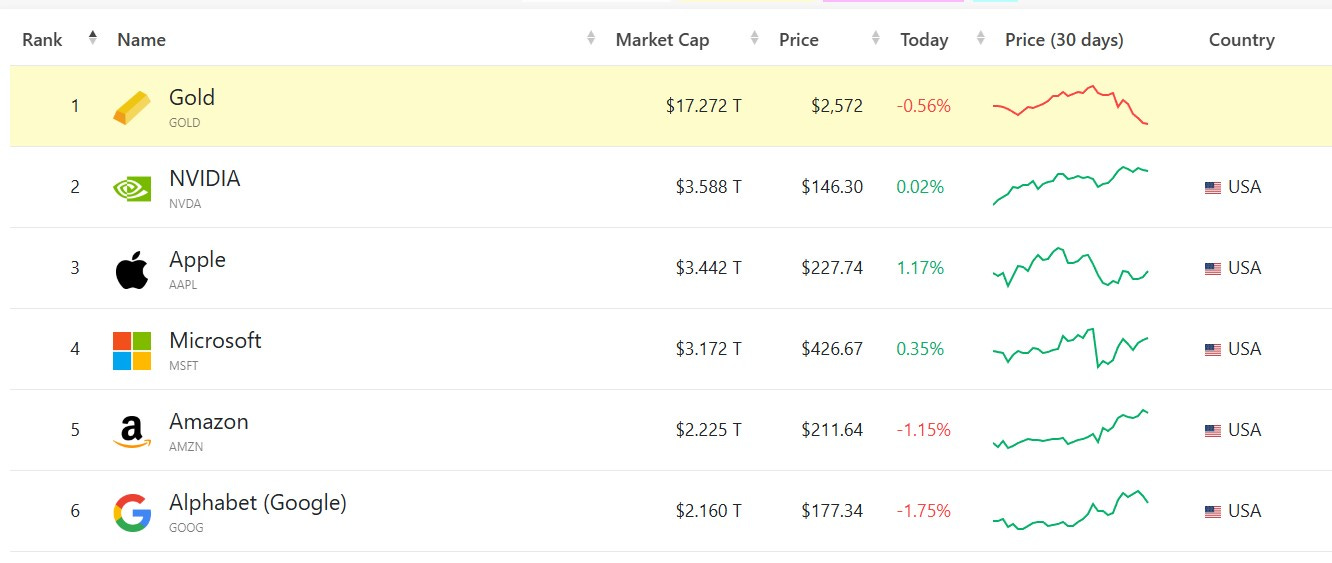

Bitcoin became the seventh largest asset in the world last Tuesday, with a market cap of $1.75 trillion.

The list below has been making the rounds of every crypto-newsletter writer this week:

https://companiesmarketcap.com/assets-by-market-cap/

That doesn’t mean every financial asset in the world is going to buy Bitcoin.

But it does mean there is at least a conversation as to why they don’t.

The Billion-Dollar Management Problem

If you have a billion dollars, where do you keep it? If you put in a bank, you could lose it all.

Remember, in the US, deposits are only insured up to $100k.

When Silvergate Bank collapsed in March of 2023, the Fed allowed for deposits greater than $100K to be paid out, just to prevent a bank run. But that was a one-off.

The bailout, I mean. Because US banks go bankrupt all the time, here is the list from 2009 to 2024.

It gets worse for money overseas. Banks outside the US don’t tend to go bankrupt, they get nationalized.

Then, it’s hello currency controls. Or your assets get frozen.

Also, we haven’t talked about yield yet.

For decades, US treasury bonds were the place to be. Until inflation hit the US and the rest of the world in 2021, and bond yields plummeted.

If you bought a five-year bond in 2020, you got burned. If you bought a ten-year bond, then it was a massacre.

In 2022, ten-year bonds had their worst year since 1788.

Presently, big-money investors are flocking to gold, as they have for centuries, if not for millennia. Gold price is at an all-time high.

And it has a market cap of $17 trillion.

Just in offshore tax havens (i.e. non-US money), there is any from $21 trillion to $33 trillion US stashed away. It has to go somewhere.

But gold has its problems. There are storage costs, to state the obvious.

But a bigger issue is fraud. Do you think you have a storehouse of gold bars somewhere, or is it a storehouse of tungsten bars painted gold?

Before Bitcoin, if you had a billion dollars, these were your choices: US dollars, US treasuries, or gold.

But with Bitcoin becoming a respectable option for institutional money, that’s changing fast.

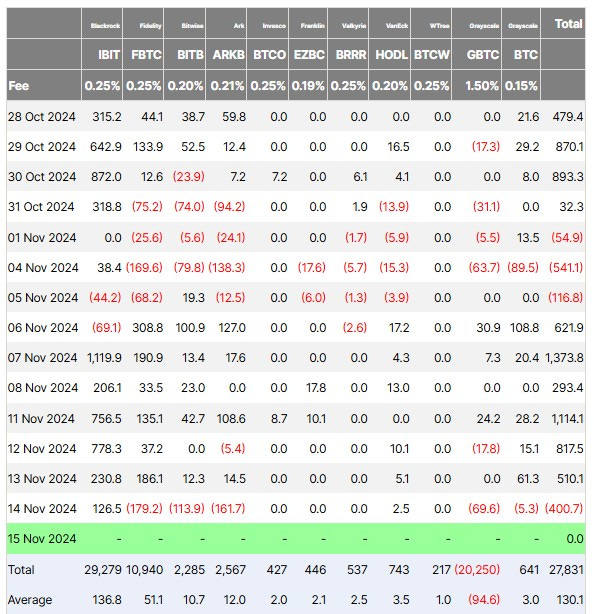

Total US Bitcoin ETF inflows are now $29 billion, and the trend is accelerating. In the last seven days, we saw two days where the inflow was more than $1 billion.

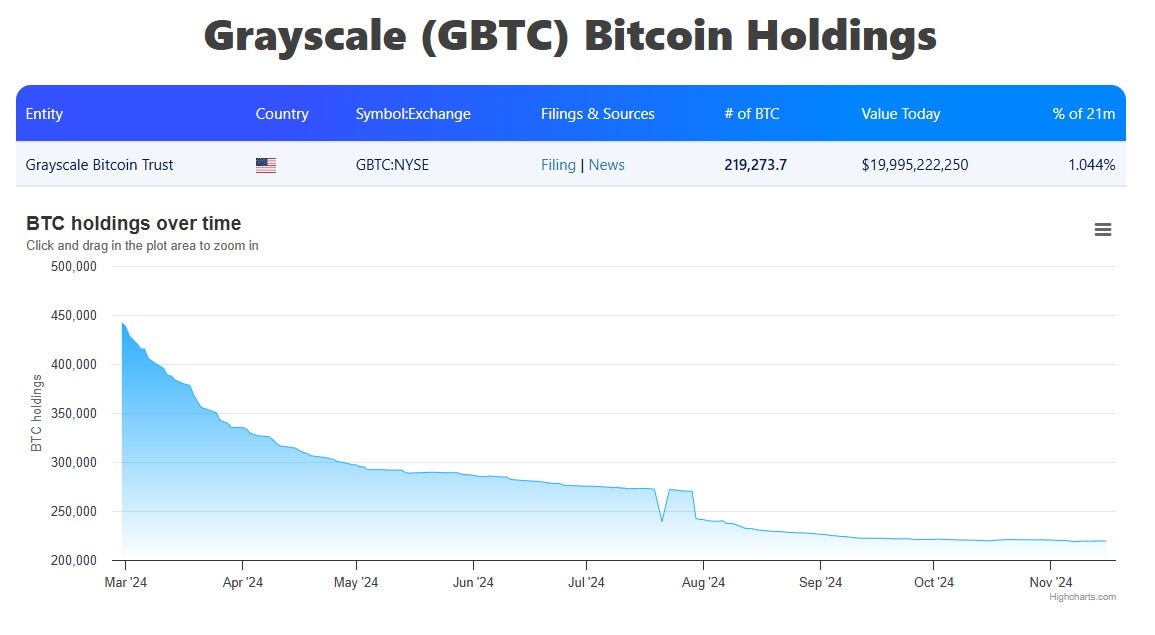

The biggest seller of Bitcoin this year? The Greyscale Bitcoin ETF, with more than $20 billion of outflow.

But Greyscale has sold more than half of Bitcoin inventory this year. In another six months at most, its selling will no longer move the market in any significant fashion.

https://treasuries.bitbo.io/grayscale/

Conclusion

It is counterintuitive to think that when the price of an asset goes up, that makes it more attractive to buyers.

But the key concept to grasp is liquidity or lack thereof.

Worldwide, there are tens of trillions of dollars in assets that are highly illiquid, much to the consternation of its owners.

There is a huge demand for a medium of exchange and storage that can be fungible and liquid.

For much of human history that was gold. Then, post World War II and for the first quarter of the 21st century, it was the US dollar.

But now institutional investors are looking for alternatives.

Josef Stalin has a suggestion.